local services tax berks county pa

EIT Earned Income Tax Berks EIT Resident 5 Non-resident 1 Local Services Tax Berks EIT 52. Pennsylvania has a 6 sales tax and Berks County collects an additional NA so the minimum sales tax rate in Berks County is 6 not including any city or special district taxes.

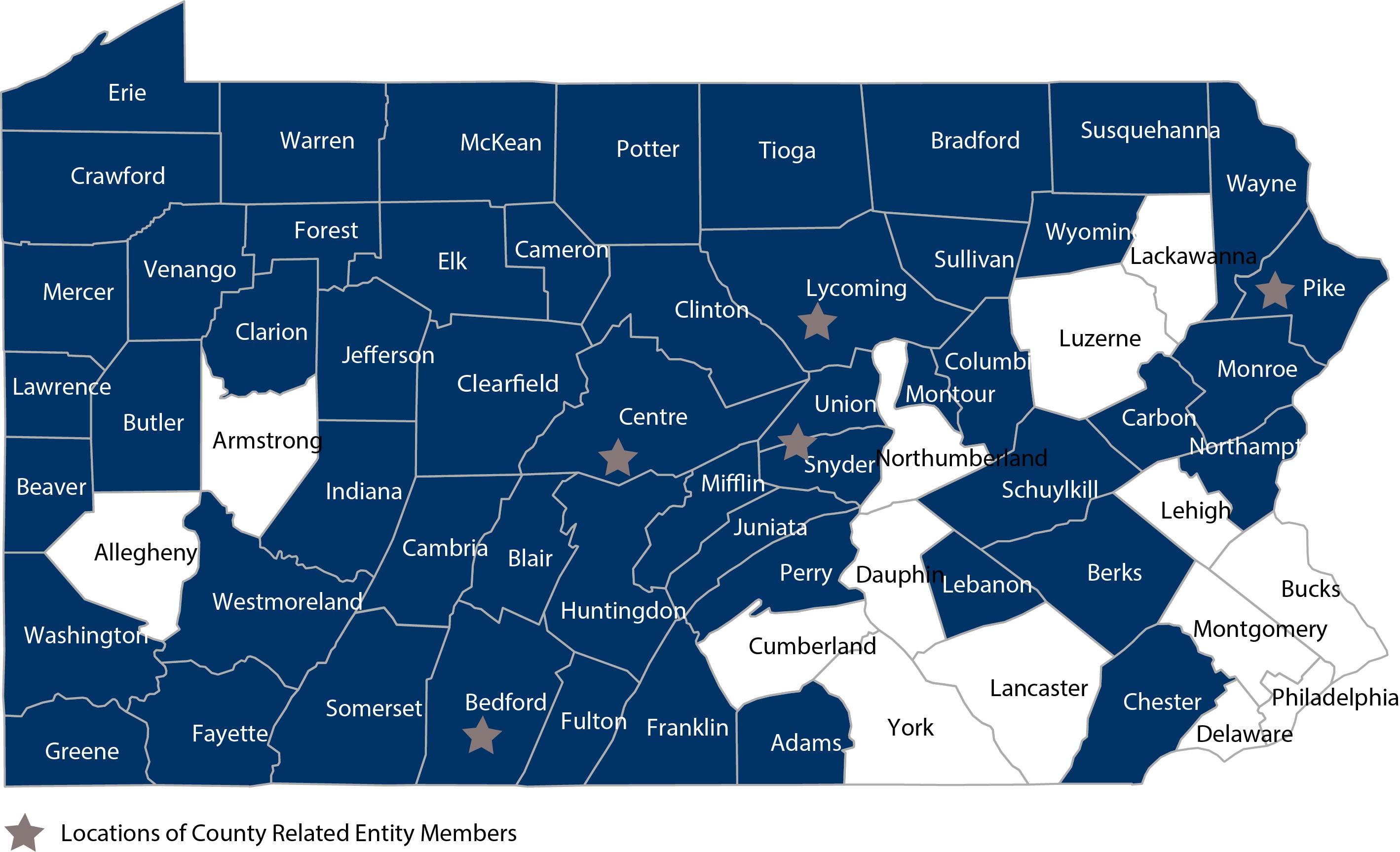

Pcorp County Commissioners Association Of Pennsylvania Ccap

Theyre a funding anchor for governmental services used to maintain cities schools and special districts such as sewage treatment plants public safety services transportation etc.

. The total sales tax rate in any given location can be broken down into state county city and special district rates. Local Services Tax LST 5200. Vacation House Check Request.

2021 Pennsylvania local income taxes We have information on the local income tax rates. Tom Rader will have more on how to spot scams before its too late. WYOMISSING Pa-- BUSINESS WIRE --Today UGI Energy Services LLC.

WYOMISSING Pa May 19 2022--UGI Energy Services commemorates spring 22 visits to schoolsscholarship orgs it supports through Pas. Factories warehouses branches offices and residences of home. Local Services Tax.

Local Income Tax Requirements for Employers. This tax is collected by Berkheimer Associates. BOROUGH of LEESPORT EARNED INCOME TAX ORDINANCE An ordinance levying a tax on earned income and net profits.

May 19 2022 0800 AM Eastern Daylight Time. The name of the tax is changed to the Local Services Tax LST. Berks County Assessment Office Berks County Parcel Search.

This table shows the total sales tax rates for all cities and towns in Berks County. In addition to federal and state taxes there are three local authorities with the. The Boyertown School District is paid 5 per year and the balance of 47 is paid to the Township.

Act 15 of 2020 On May 7 2020 the Commonwealth of Pennsylvania passed Act 15 of 2020 which took effect on April 20 2020 that gave local municipalities the ability to revise the real estate tax payment. A 36 tax would be collected at 69 cents a week for employees paid weekly or at 3 a month for employees that are paid monthly. A Berks County woman was scammed out of nearly 115000.

Berks Countys district attorney gave an update on the countys drug. 35 minutes agoReturn to pre-pandemic tax collection rates gets part of the credit. Topton PA 19562 610682-2541.

Ad A good tax preparer will help simplify your filing and make sure its done right. This tax is withheld from individual pay checks at the rate of 1 per week. Online Payments Xpress Bill PAy.

Find the best Local Services on Yelp. 2006 and Previous Years Borough of Topton 205 S. The Berks Earned Income Tax Bureaus due date for the 2021 local individual income tax return is also changed to April 18 2022.

M-F 8a-430pm at the Township Office 2004 Weavertown Road Douglassville PA 19518. May 17 2022 at 700 am. Oz who was backed by former President Donald Trump did better with in-person.

If a tax is levied at a combined rate exceeding ten dollars 10 in a calendar year a person subject to the local services tax shall be assessed a pro rata share of the tax for each payroll period in which the person is engaging in an occupation. These tax sources generate just over 42 million of our total annual revenues of 51 million. Requiring employers to withhold and remit tax.

Ad Find Accountants you can trust and read reviews to compare. 100s of Top Rated Local Professionals Waiting to Help You Today. 9 hours agoElection officials say voter turnout among republicans was 37 the highest for a primary in more than two decades.

This is the date when the taxpayer is liable for the new tax rate. Questions and refunds refer to. Local Witholding Tax EIT 1 Tax.

If you have issues or question with your tax please contact them. 2007 and Forward Berks EIT Bureau 1125 Berkshire Blvd Suite 115 Wyomissing PA 19610 610372-8439. EARNED INCOME TAX COLLECTOR Earned Income tax will be collected by the Berks Earned Income.

We have high standards and only recommend professionals with a track record of success. Search reviews of 1274 Berks County businesses by price type or location. Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the.

Realty Transfer Tax5 Amusement Tax Administrator Diane Dejesus 10. Property taxes have traditionally been local governments near-exclusive area as a funding source. Examples of business worksites include but are not limited to.

LOCAL SERVICES TAX. For instance a 52 tax would be collected at 1 per week for employees paid weekly or at 433 per month for taxpayers paid monthly. The Berks Earned Income Tax Bureaus due date for the 2021 local individual income tax return is also changed to April 18 2022.

Real Estate - 001 5 mills. The Reading School Board approved a draft this week of its nearly 390 million budget for the 2022-23 school year with no tax. Office mails property tax notices to the owner of record etc These losses may be used to offset net profits but not your wages.

Real Estate Tax Rates. Prices to suit all budgets. If you work within the Township whether as an employee or a business owner a tax of 52 per year is assessed.

If the total LST rate enacted is 10 or less the tax is to be collected in a lump sum. Per year and is paid by anyone who works in Douglass Township. This tax is 52.

Local Services Accountants PA Accountants in Berks County Accountants in Berks County PA We will give you information about the tax benefits of small business ownership e-filing and the affordable accountants near Berks County PA. Real Estate Transfer Tax Local Services Tax and Per Capita Tax. Thumbtack finds you high quality Accountants lets you book instantly.

7 hours agoUGI Energy Services Provides 200000 in Scholarships to Pennsylvania Schools. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in PA. Real Estate - 006935.

We need your help in Berks County Delaware meaning that rates must be higher to collect the same amount of revenue. BERKS EIT NOTICE Regarding the 2018 Local Services tax. H erbein Company Inc.

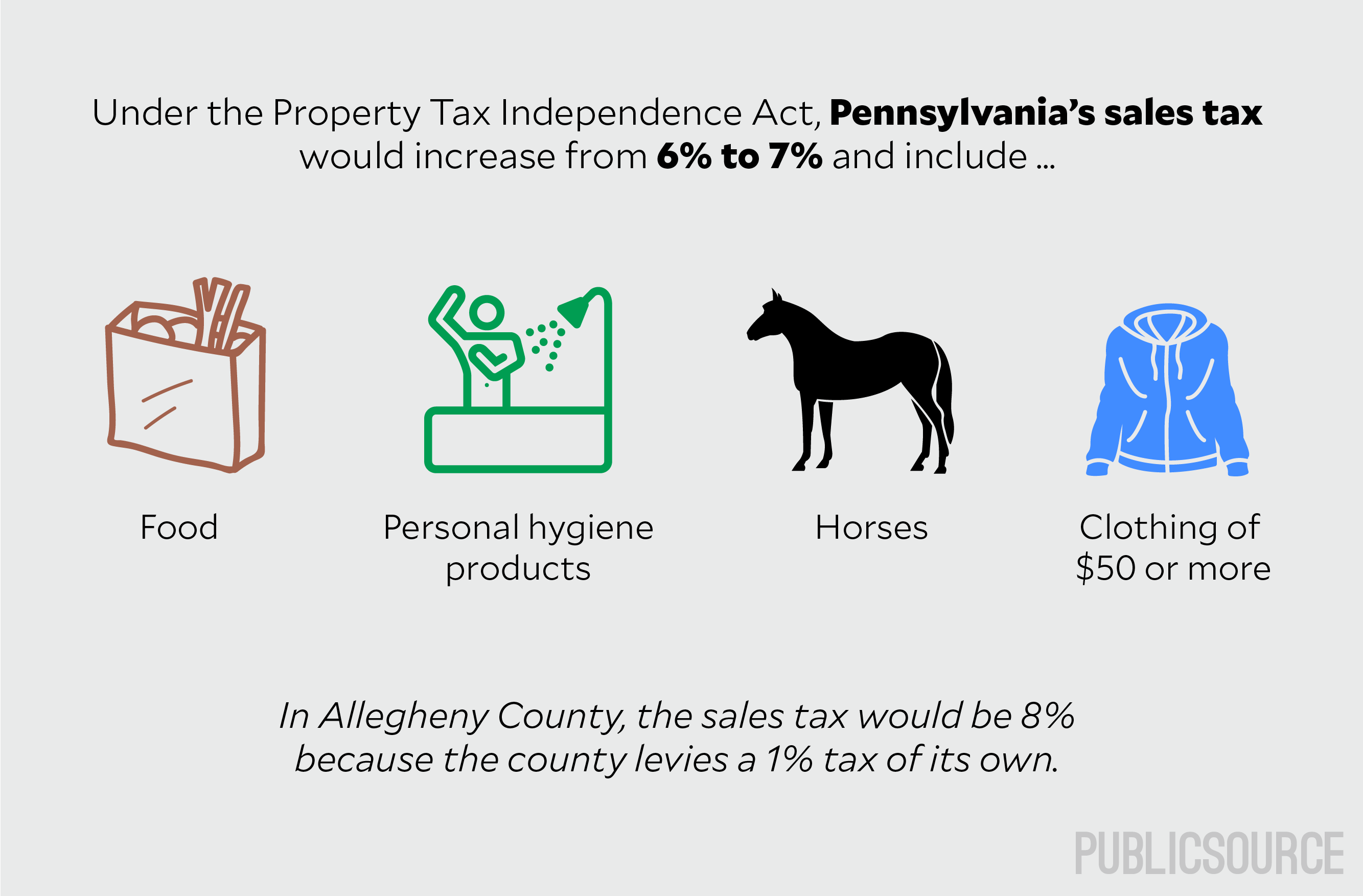

What Would No Property Taxes In Pa Mean For School Districts Taxpayers Publicsource

Phl Airport Parking Coupon Airport Parking Coupons Airport

Berks County Sheriff Pennsylvania Pa Patch A6 County Sheriffs Berks County Sheriff

Pin On Small Business Websites

Llc In Pa How To Start An Llc In Pennsylvania Truic

Norwin Democrats To Hear Candidates From New 12th Congressional District Triblive Com

Property Manager Resume Example Writing Tips Resume Genius Manager Resume Resume Examples Professional Resume Examples

Early Intervention Ei Berks County Intermediate Unit

Allentown State Hospital Water Tower Water Tower Tower Water

Larry Hailsham Jr Larryhailsham Twitter

Efiling Berks Earned Income Tax Bureau

These 11 Municipalities In Berks County Raised Property Taxes For 2021 Map The Mercury

Larry Hailsham Jr Larryhailsham Twitter

Pennsylvania Property Tax Calculator Smartasset

What Would No Property Taxes In Pa Mean For School Districts Taxpayers Publicsource

What Would No Property Taxes In Pa Mean For School Districts Taxpayers Publicsource